Accrete, a fintech startup, focused on using AI to help investors make better investing decisions. Topic Deltas, one of the product offerings, was a dashboard aiming to surface market-moving insights from company earnings calls. I led the design end-to-end, from conducting user interviews to iterating on prototypes to delivering handoffs. I collaborated with 1 Product Manager, 2 Data Scientists, and 3 Engineers from February 2019 to August 2019.

The internet has made huge volumes of company data readily available to investors. To generate macro-level as well as company-specific insights in a timely manner, however, has been increasingly challenging due to the information overload in the financial markets.

If an investor were to go through all the earnings transcripts in the past 8 quarters of all the companies in the S&P 500 Index, it could take weeks to decipher the insightful information across different sectors, industries, and companies. In this project, our goal was to create a tool that helps investors discover investment opportunities from earnings calls transcripts in an efficient and scalable way.

Monitoring all the sectors and industries imposes a great cognitive burden for investors

I talked with 5 domain experts to understand the workflow of analyzing earnings reports and the challenges during the process. Below is the summary of the findings:

Oftentimes, investing signals lie within the quarterly changes in some aspects of a company or changes across companies in a given quarter. These data are scattered and can take a long time for investors to aggregate and draw comparisons.

Remarks by a company in the earnings calls are carefully prepared, and therefore slightly different language on the same topic can have significant implications. To quantify these nuances, however, is no easy task.

Industry trends across companies develop rapidly as the earnings season progresses, and topics that have significant implications change over time. This dynamic nature makes it difficult to capture the trends and determine what to follow in a timely manner.

Three key elements of making an investing decision

We started exploring ideas by generating user stories based on the discovery insights. How might we surface the information investors want to see quickly?

Stories were then summarized into three categories:

I worked with the data scientists to understand the technical feasibility of our ideas and what we were able to capture from the unstructured data from earnings transcripts. This allowed me to ideate on the designs with a realistic perspective on data capabilities.

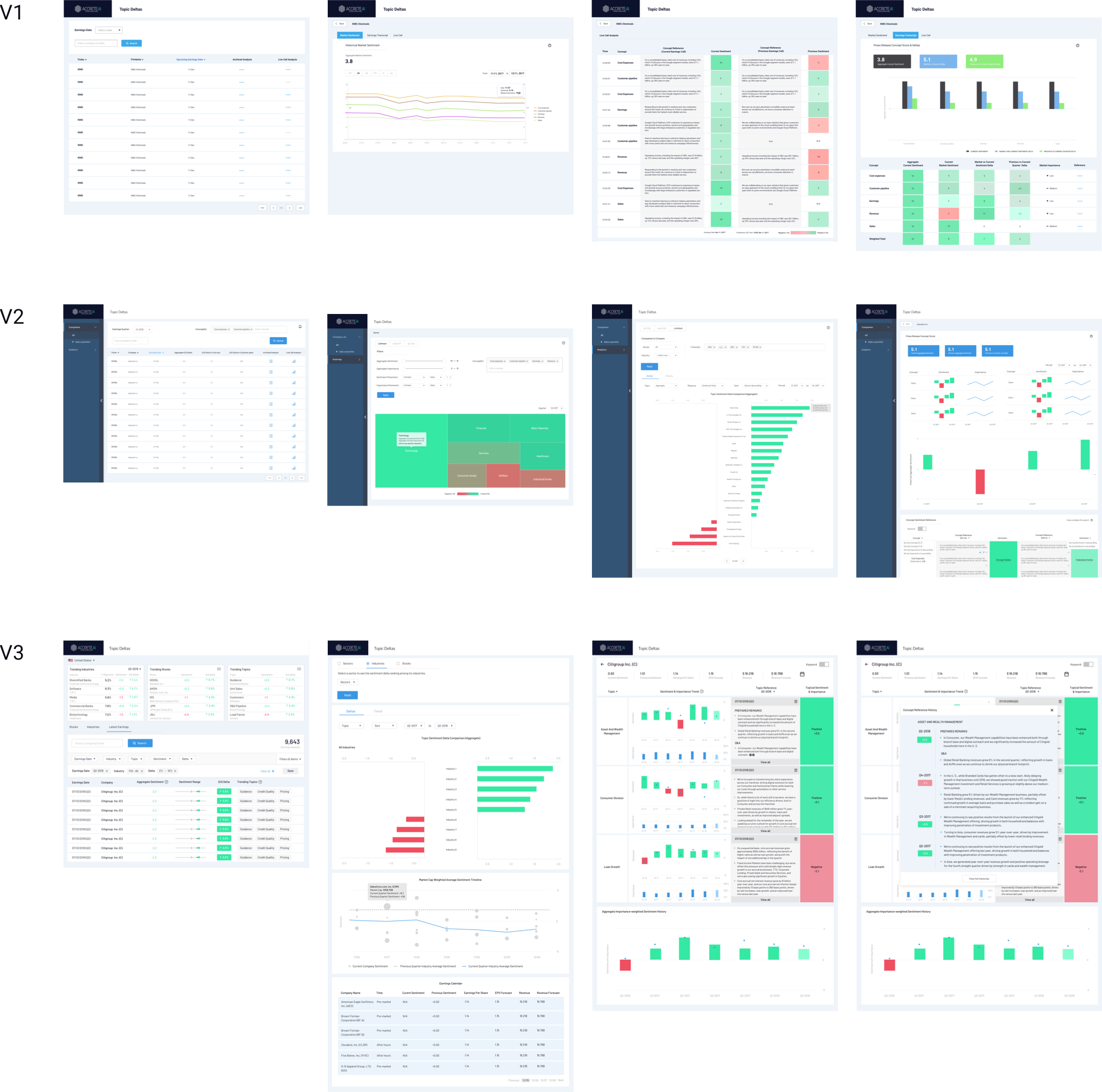

We went through a couple of iterations during a few rounds of testings internally and with several clients.

Early mockup iterations

With the early design iterations, we were able to identify some key insights into how users would use the product to find what they need in the investment process:

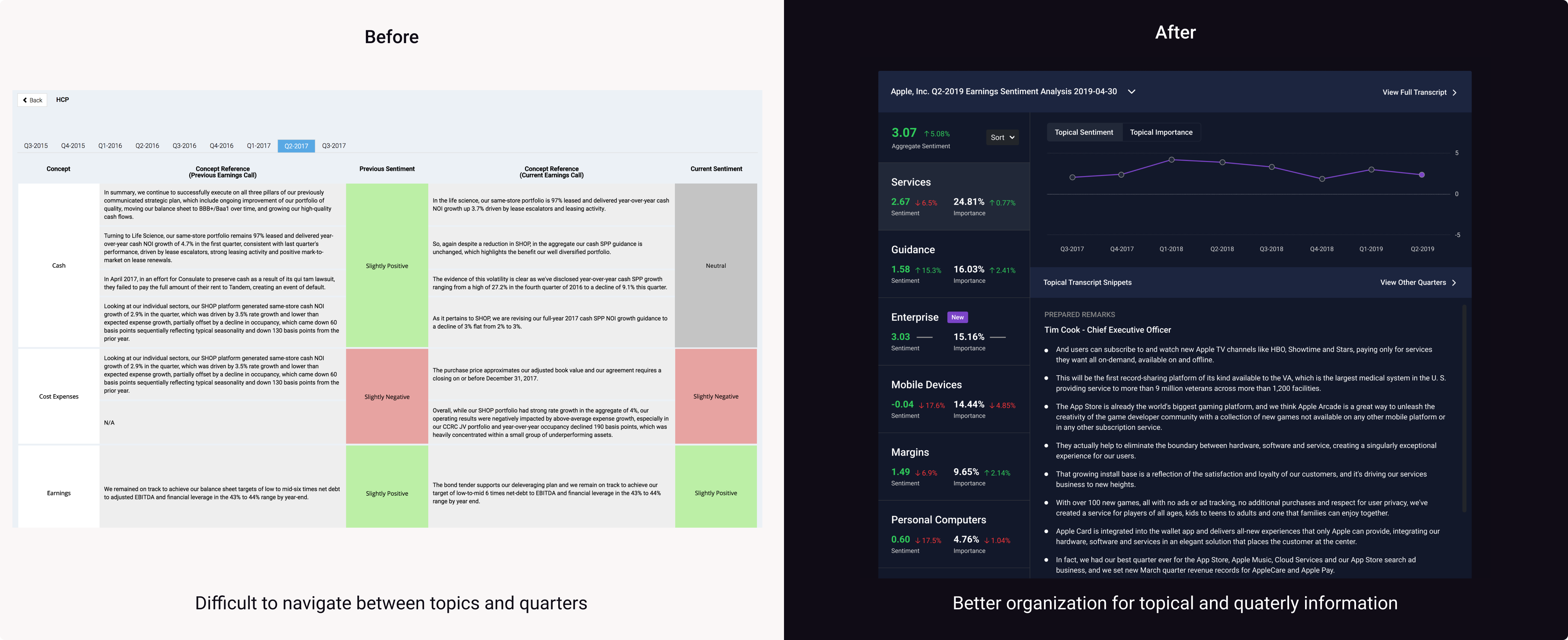

Users found it difficult to trust the system on sentiment scoring on a topic or company without knowing the context in the transcript. They needed to look at the corresponding paragraphs to validate.

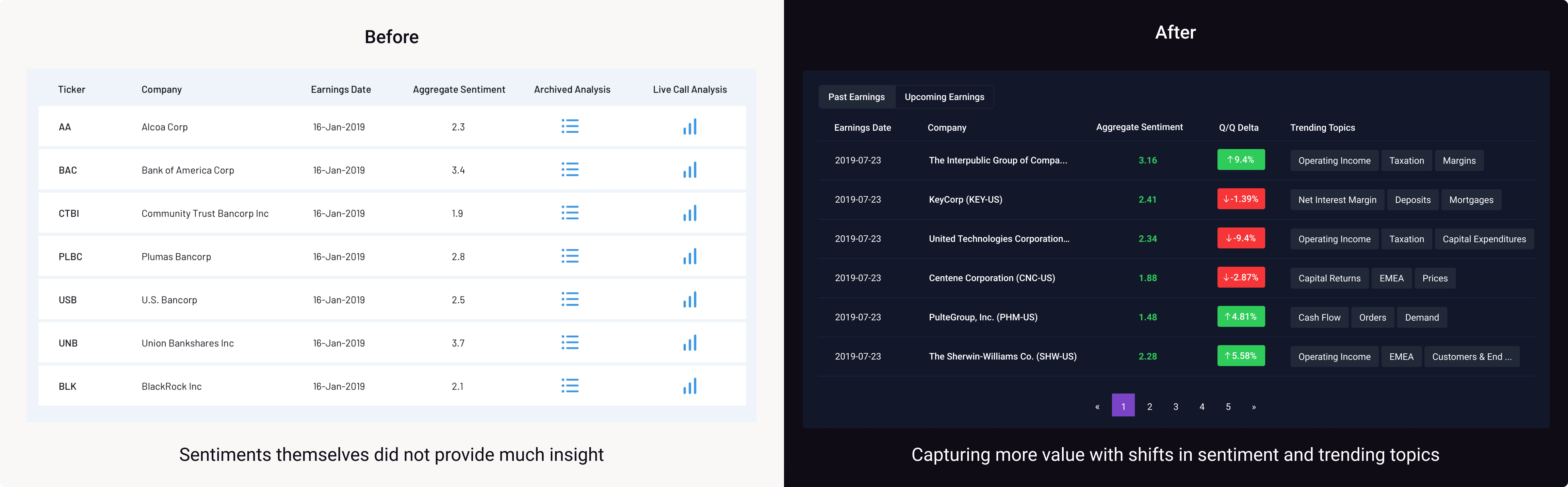

Since companies always try to sound positive in earnings calls, the sentiment on a topic in a given quarter does not provide much on where the company is heading. It’s the shift in sentiment from quarter to quarter that the users care more about.

Topic Deltas reads through earnings transcripts in a granular bottom-up way measuring topical sentiment changes across calls and between industry peers, giving investors the unique knowledge that scales their expertise.

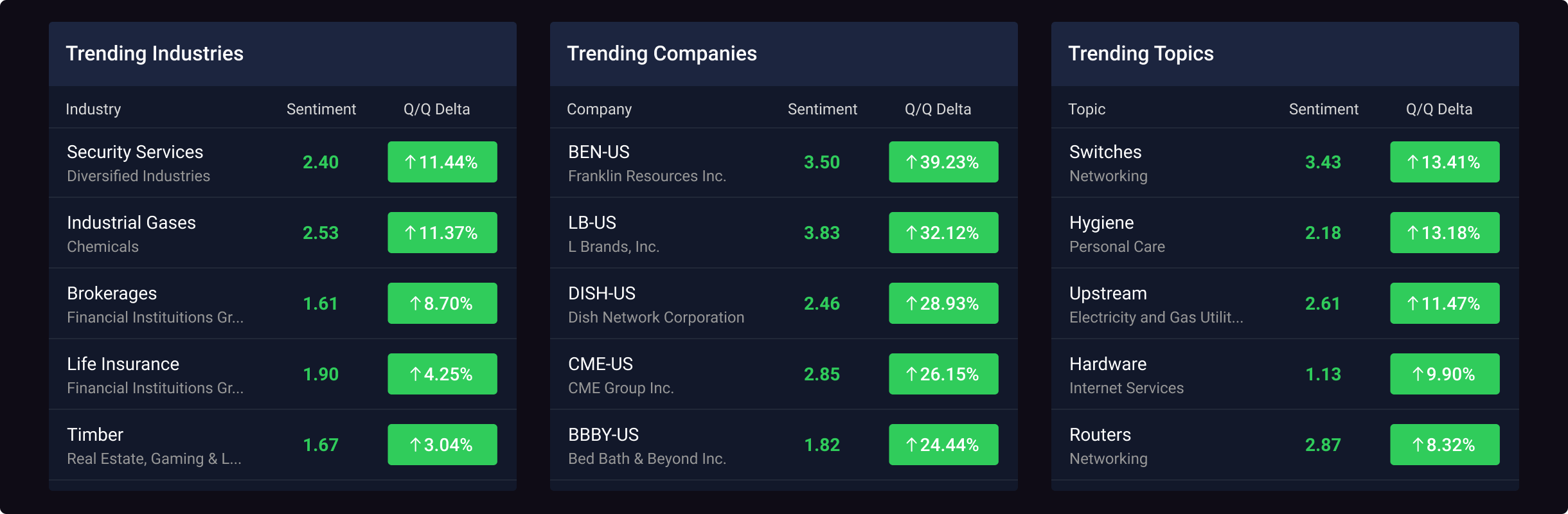

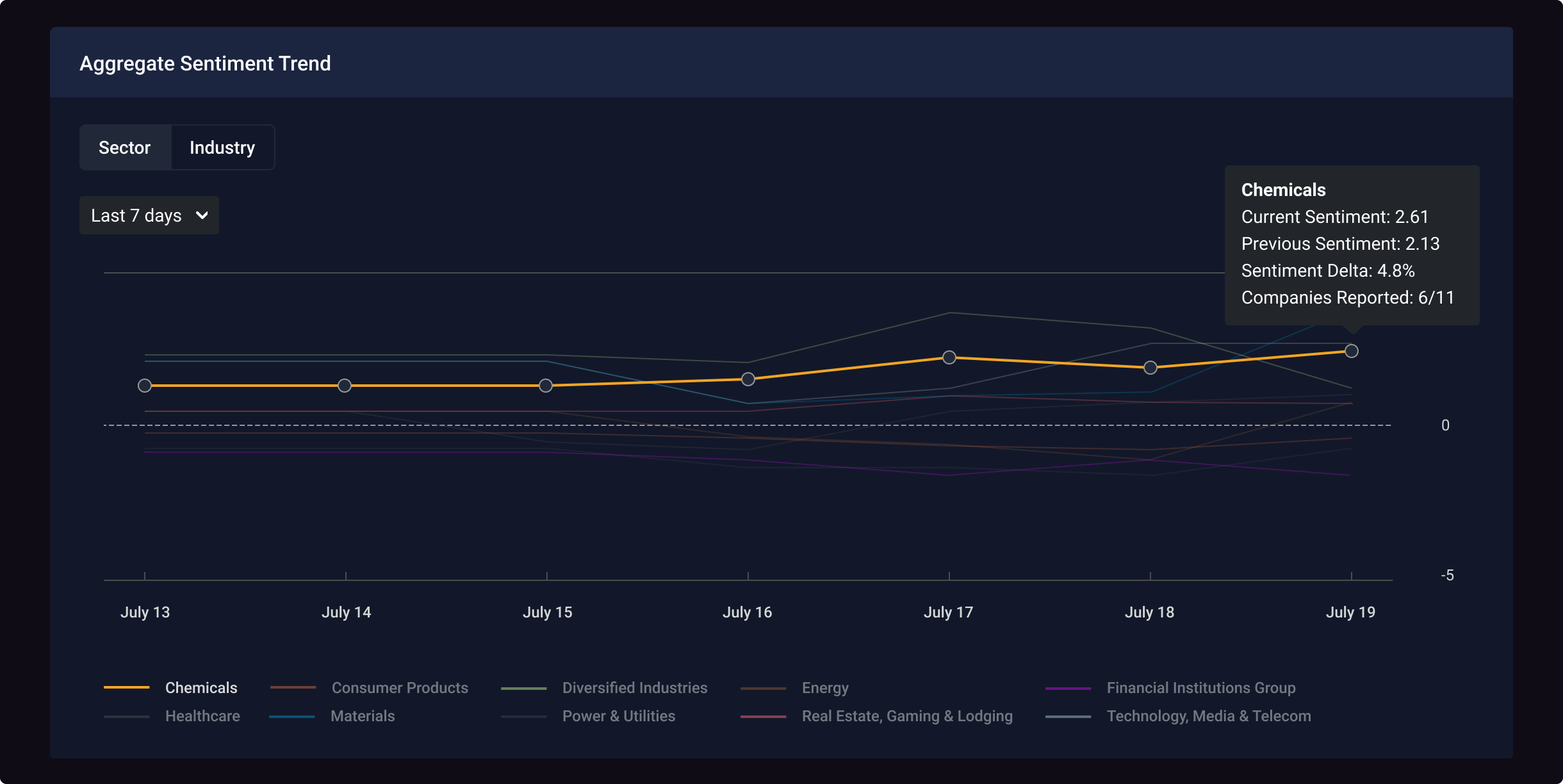

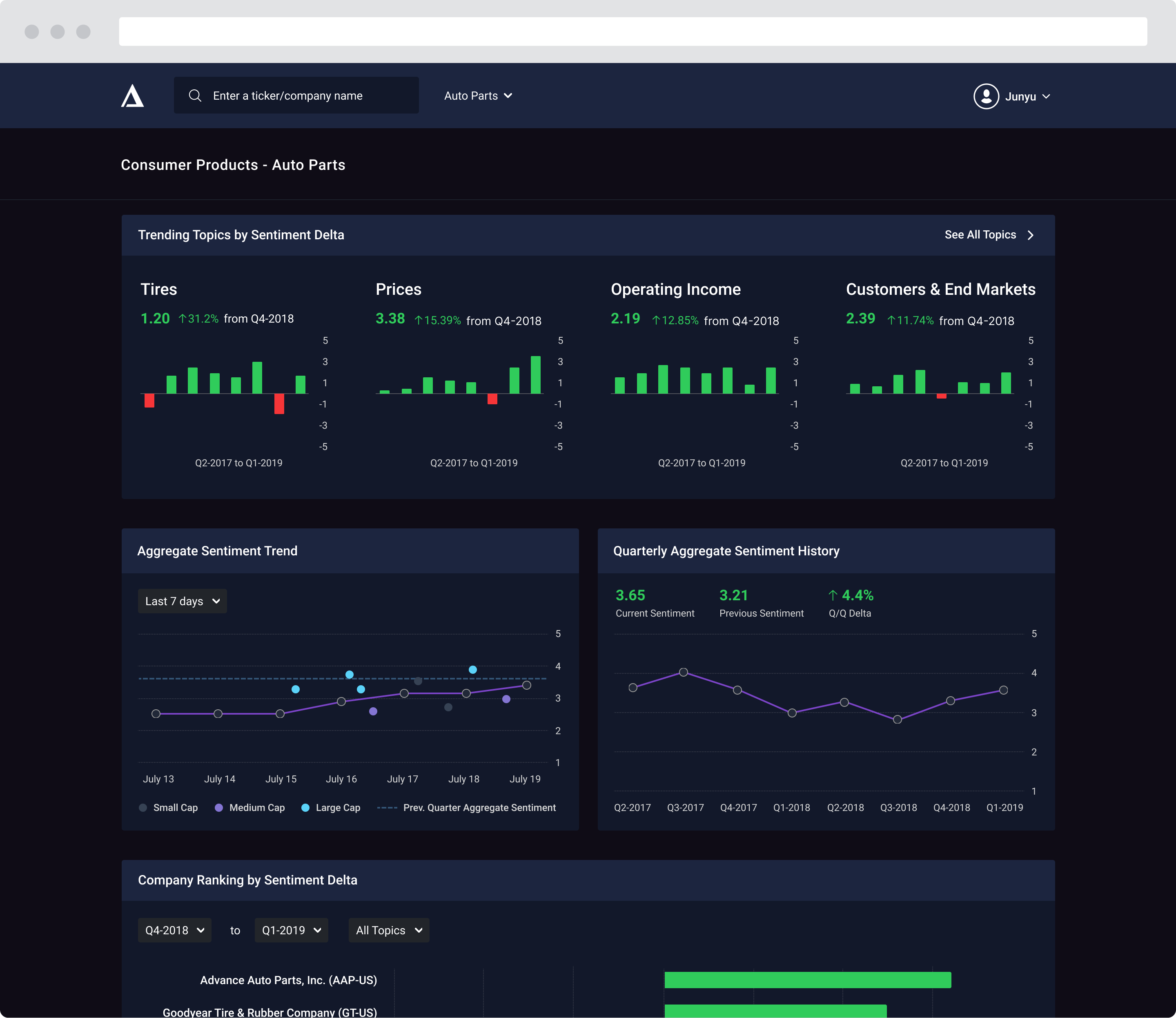

One of the biggest challenges for analysts or investors is tracking the macro trends across sectors, industries, and companies. The three widgets on the top allow users to find what's trending from a macro-level perspective and decide where to pay attention to.

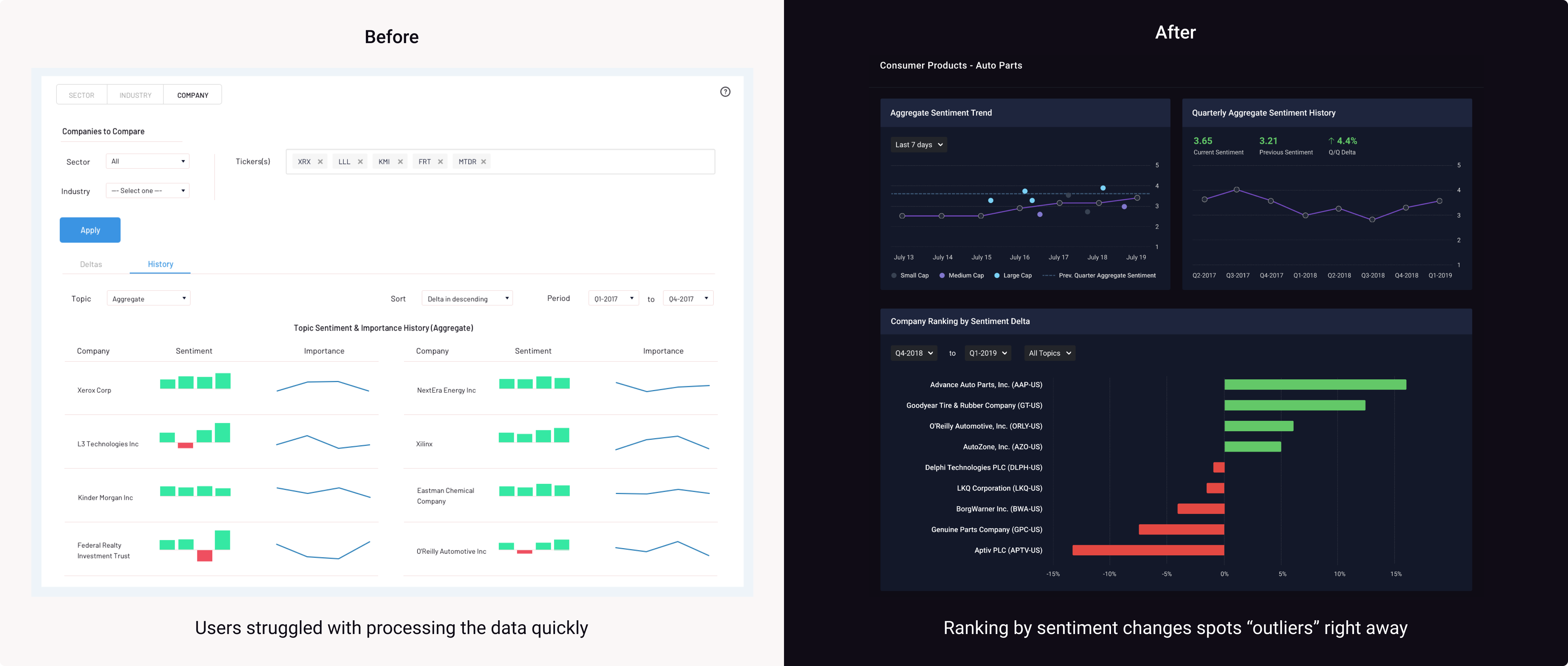

Capturing the dynamic change among sectors and industries as new calls come in was not easy. In the early iterations, we used a heat map where different shades of green and red represent positive and negative sentiment changes. After a couple of customer meetings and testings, we found that users cared more about which sectors or industries had more changes than others.

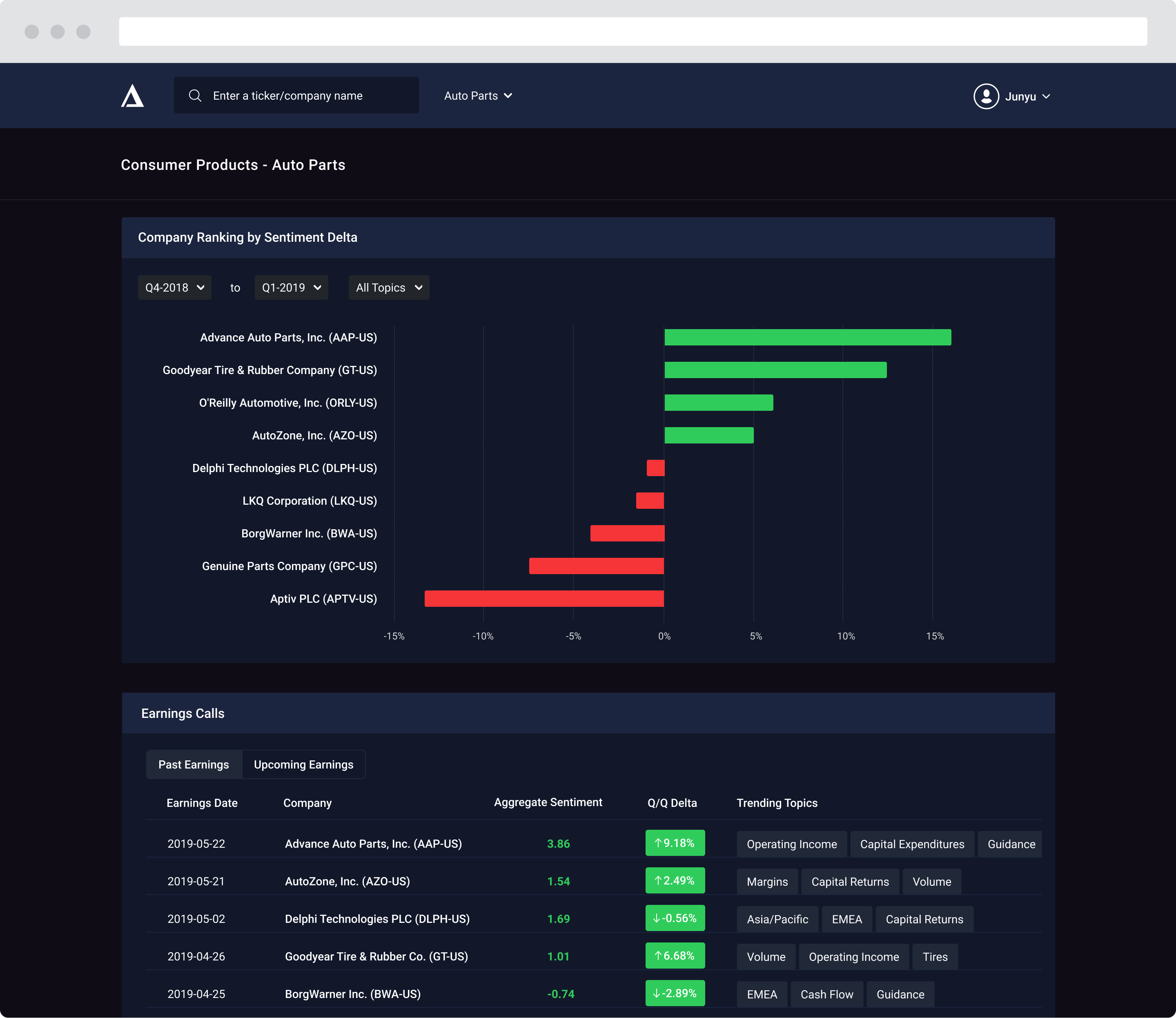

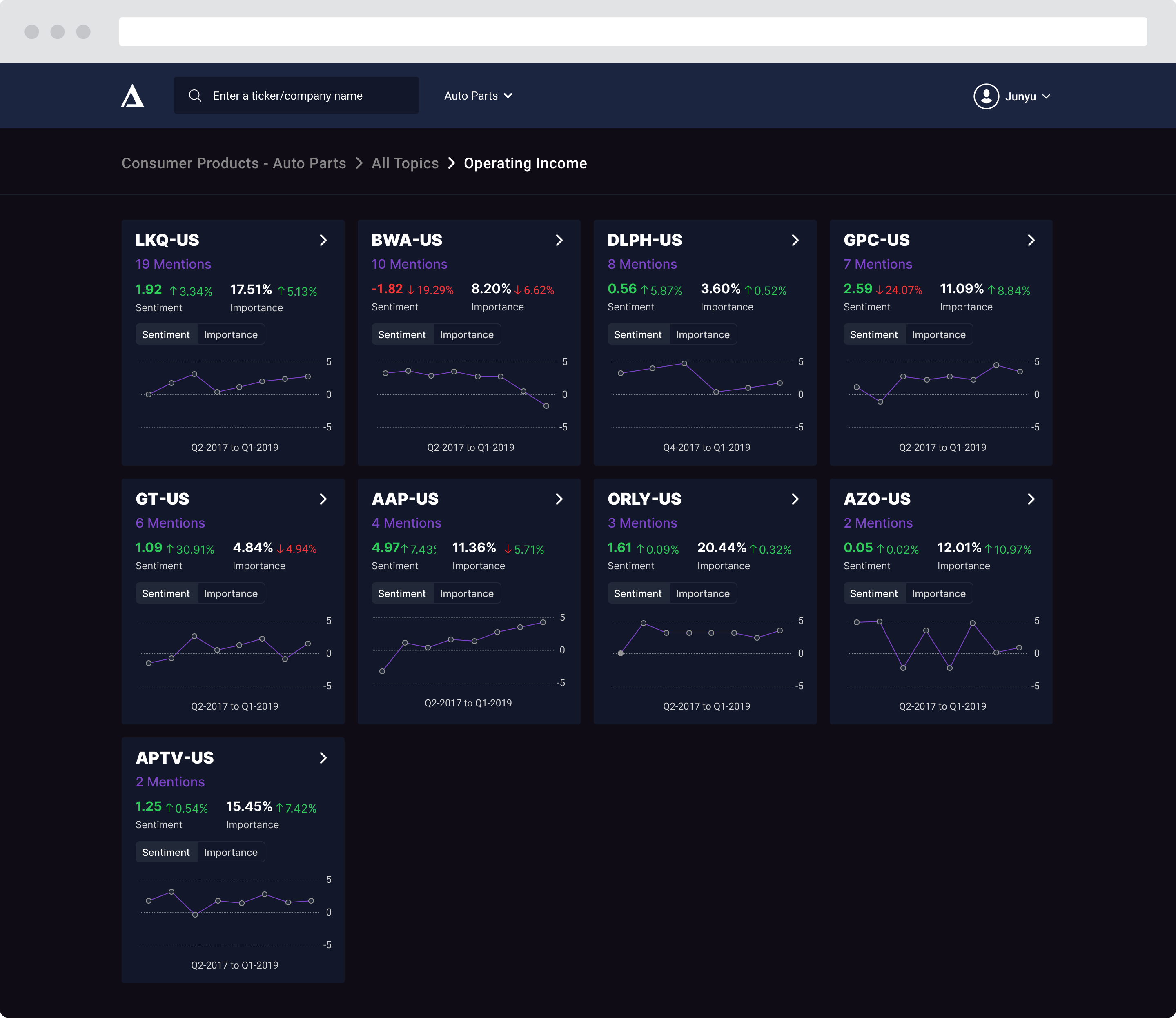

Topic Deltas analyzes topical and aggregate sentiments for each company right after the earnings call. Users can gain an edge by finding out what companies and topics have the most sentiment changes from the last quarter as soon as the company announces.

Topic Deltas identifies key themes by comparing and contrasting granular topics over time and against those referenced by industry peers. What's driving the industry markets? How the industry has evolved over time? Who has under or outperformed? Users can find all of the important information in one place.

Topic Deltas covers all the topical sentiments within an industry and allows users to dig deeper into the sentiment history in the previous quarters for every topic and company.

On the Earnings Calls page, users can compare and contrast the key statements in the call classified by different topics, as well as the historical performance for each topic. The semantic details of nuanced language not only provide the transparency of how the machine learning model works behind the scenes, but also enable investors to find patterns that were previously invisible.

I had little knowledge about investing prior to joining the team, and this project had been a challenging but rewarding learning experience for me. I learned to lean on the experts on my team and clients to get myself familiar with the domain and validate my assumptions during design iterations. Having a beginner’s mindset and being comfortable asking for help allowed me to understand the problems quickly and deliver solutions that meet both user and business expectations.